- The Closing Disclosure is a detailed final review that outlines loan terms, fees and costs to ensure transparency.

- Lenders must provide the Closing Disclosure to borrowers at least three business days before the scheduled closing date.

- After signing the Closing Disclosure, borrowers will likely move onto closing day.

What is a Closing Disclosure?

A Closing Disclosure is a detailed final review of a homebuyer’s loan terms, fees and costs.

It is a relatively new document that came out of the banking and mortgage industry reforms following the housing crisis and replaced two longtime federal forms, the final Truth-in-Lending statement and the HUD-1 settlement statement.

The new Closing Disclosure is designed to help borrowers better understand the terms of their loan and ensure transparency in the real estate transaction.

Closing Disclosure 3-Day Rule

The Closing Disclosure 3-Day Rule is a requirement established by the Consumer Financial Protection Bureau (CFPB) intended to give borrowers adequate time to review the Closing Disclosure document before finalizing a real estate transaction.

Here’s what the Closing Disclosure timeline looks like:

- Initial Closing Disclosure: The lender is required to provide the borrower with an initial Closing Disclosure at least three business days before the scheduled closing date.

- Review period: The borrower is given a three-day period to review the Closing Disclosure. Borrowers should compare their Closing Disclosure to their loan estimate and ask their lender any questions they may have before signing.

- No closing before review: Even if you review and sign the Closing Disclosure within the same day you receive it, the lender cannot proceed with closing until the three-day review period has passed.

The three-day review period allows you to compare how costs and fees may have changed since you received your loan estimate during the preapproval stage. The loan estimate does a good job of approximating loan fees, but it isn’t an exact representation of your final costs.

Loan Estimate vs. Closing Disclosure

The Closing Disclosure features the same wording and headings as the loan estimate to make it easy for the buyer to follow the changes that were made. The biggest difference between your loan estimate and Closing Disclosure is that the charges on your Closing Disclosure are finalized.

But keep in mind that there are limits to the fees and charges that can and can’t change between your loan estimate and your final Closing Disclosure.

Let’s review closing cost fees that will be present on your loan estimate and might change on your Closing Disclosure:

| Fees That Can Change up to 10% | Fees That Can’t Change | Fees That Change Without Limit |

|---|---|---|

| Government recording charges | What lenders charge for their services, such as an origination fee | Required services that you can shop for (if you do not use companies that your lender identifies) |

| Fees for third-party services that aren't directly paid to the lender or its affiliates. | Costs charged by third-party affiliates of the lender | Title services and title insurance (if you do not use companies that your lender identifies) |

| - | Transfer taxes | Initial deposit for your escrow account |

| - | Any costs for which the lender doesn’t allow you to shop for competing offers | Prepaid interest charges |

| - | - | Homeowners insurance charges |

Sample Closing Disclosure and Page-by-Page Breakdown

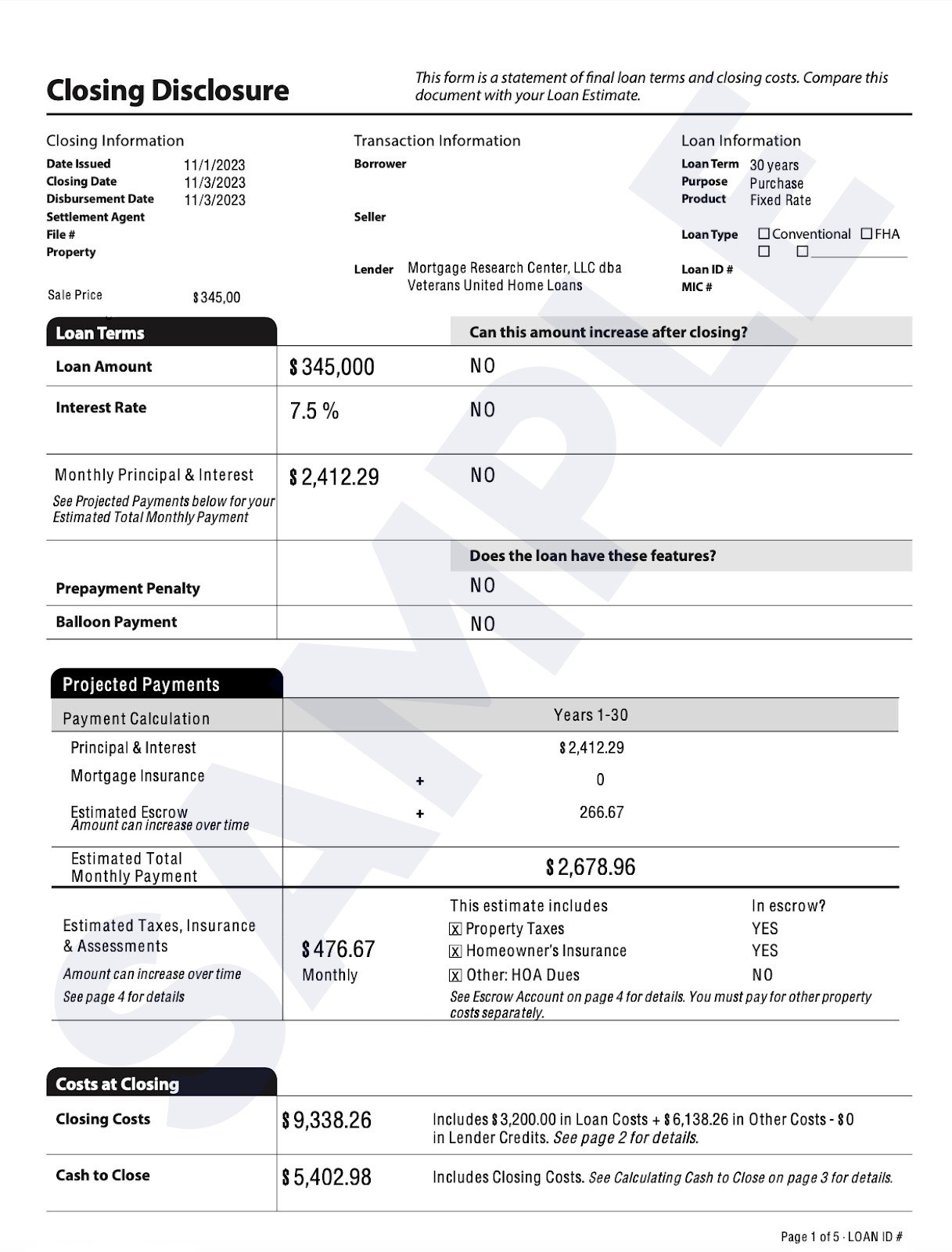

Page 1

The first page of the Closing Disclosure features the same headings and categories as the first page of the loan estimate. You’ll be able to see how your estimated total monthly payment has changed from your loan estimate, if at all. You’ll also see final tallies for your closing costs and the overall amount of cash needed to close.

Here’s a closer look at what page 1 will cover:

- Loan amount: This section provides an overview of the total loan amount, interest rate and monthly principal and interest payment. This section also indicates whether these values can increase or change, such as if you have an adjustable-rate mortgage or whether or not you have a balloon payment.

- Interest rate: Information about your borrowing costs, annual percentage rate (APR) and total interest percentage (TIP) that you can use to compare with other loan offers.

- Prepayment penalty: This will tell you if you have a prepayment penalty on your loan terms and what the amount is. If you have opted into a prepayment penalty, lenders can charge you for paying off your mortgage early.

- Projected payments: This table details the estimated monthly payments over the life of the loan, including any mortgage insurance, property taxes and homeowner's insurance. It also indicates if these payments can change.

- Monthly payments: Your projected monthly payments over the life of the loan broken down by principle and interest.

- Closing cost fees: A detailed breakdown of your estimated loan-related closing costs by category, such as origination charges, appraisal fees, title insurance, government recording charges and more.

- Cash to close: The amount of cash you’ll need to close. It accounts for your down payment, any deposit you've already made and the closing costs or other funds you need to pay.

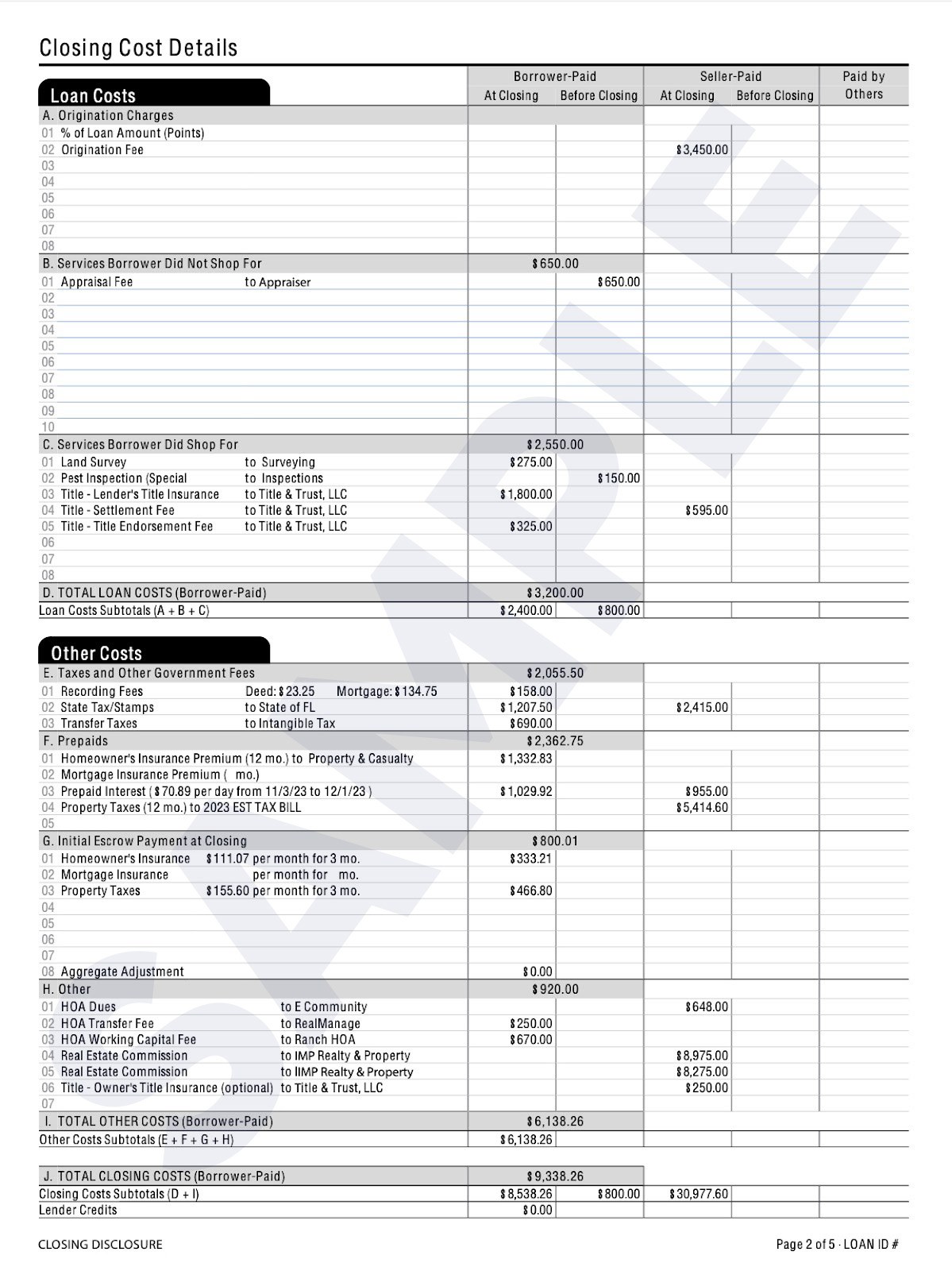

Page 2

The second page provides a full breakdown of all closing costs by type, detailing which closing costs the buyer pays and which the seller pays.

Here’s a closer look at what page 2 covers:

- Origination charges: Include your lender's application, underwriting fees and any discount points you bought.

- Services the borrower did not shop for: These are third-party services your lender requires to get a loan. For example, a VA loan Closing Disclosure would include an appraisal fee in this section because it is a requirement for a VA loan.

- Services the borrower did shop for: Borrowers can select their preferred service providers for certain items, sometimes resulting in cost savings. This section outlines the services and service providers the borrower chose. Examples of these services include a title search, title insurance and pest inspection.

- Other costs: Various closing costs that are not directly related to the loan or the lender's charges. These may include fees and expenses such as:

- Homeowners Association (HOA) dues: If the property is part of a homeowners association, this might consist of a pro-rata share of annual dues.

- Initial escrow payment at closing: The initial amount required to fund the escrow account for the payment of property taxes, homeowners insurance and other escrowed items.

- Prepaids: Such as homeowners insurance, mortgage insurance and property taxes.

- Other Fees: This category can encompass a range of miscellaneous charges that may be specific to the transaction or location, such as home inspection fees, home warranty fees, real estate commissions, etc.

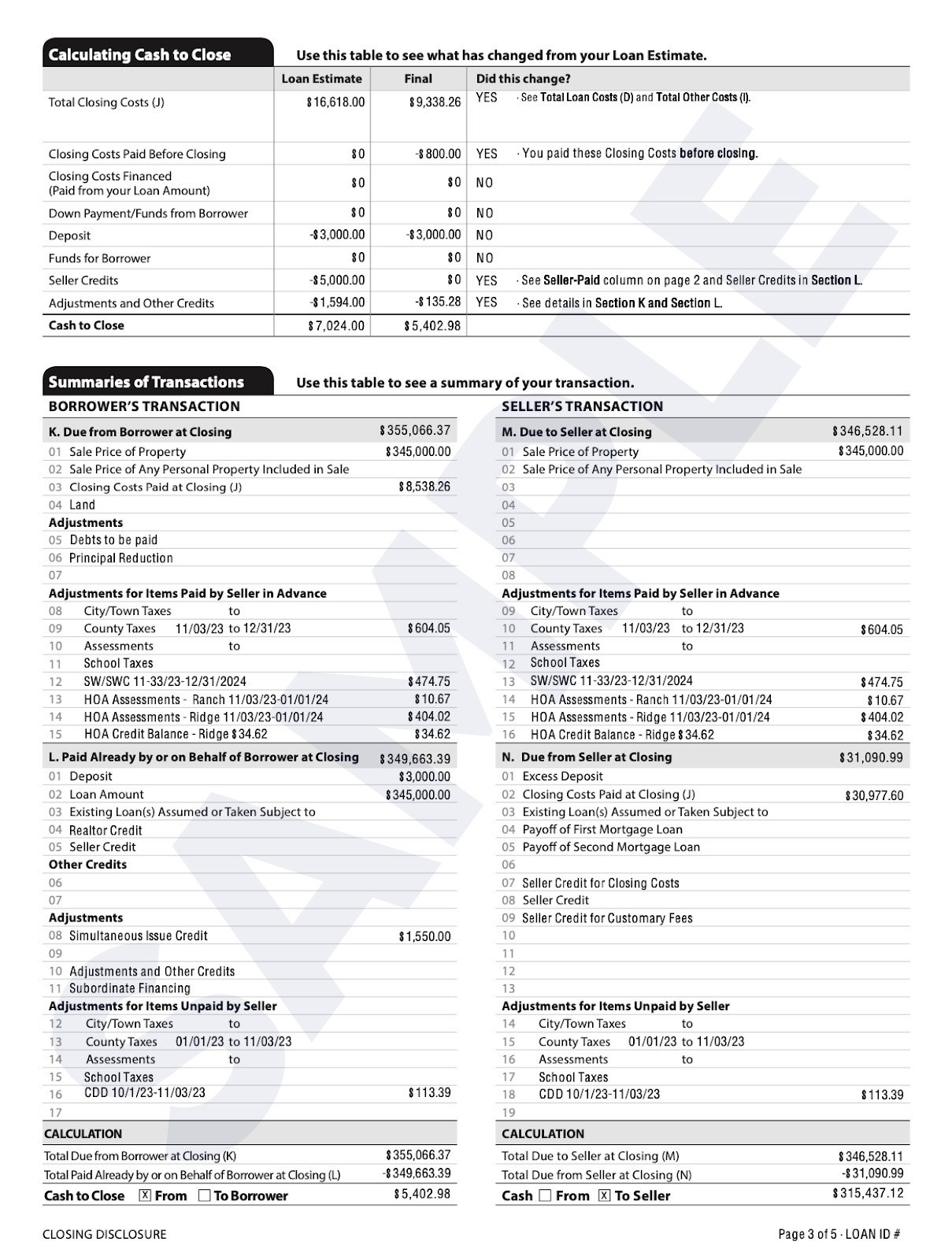

Page 3

The third page contains a table called “Calculating Cash to Close,” comparing the final cash-to-close calculation to the initial numbers from your loan estimate. It will show you which specific items changed and briefly explain why.

You’ll also see a “Summaries of Transactions” on page 3 from the buyer’s and the seller’s perspectives. This will show you the total cash needed to close and how much cash the seller stands to gain from the sale of the home.

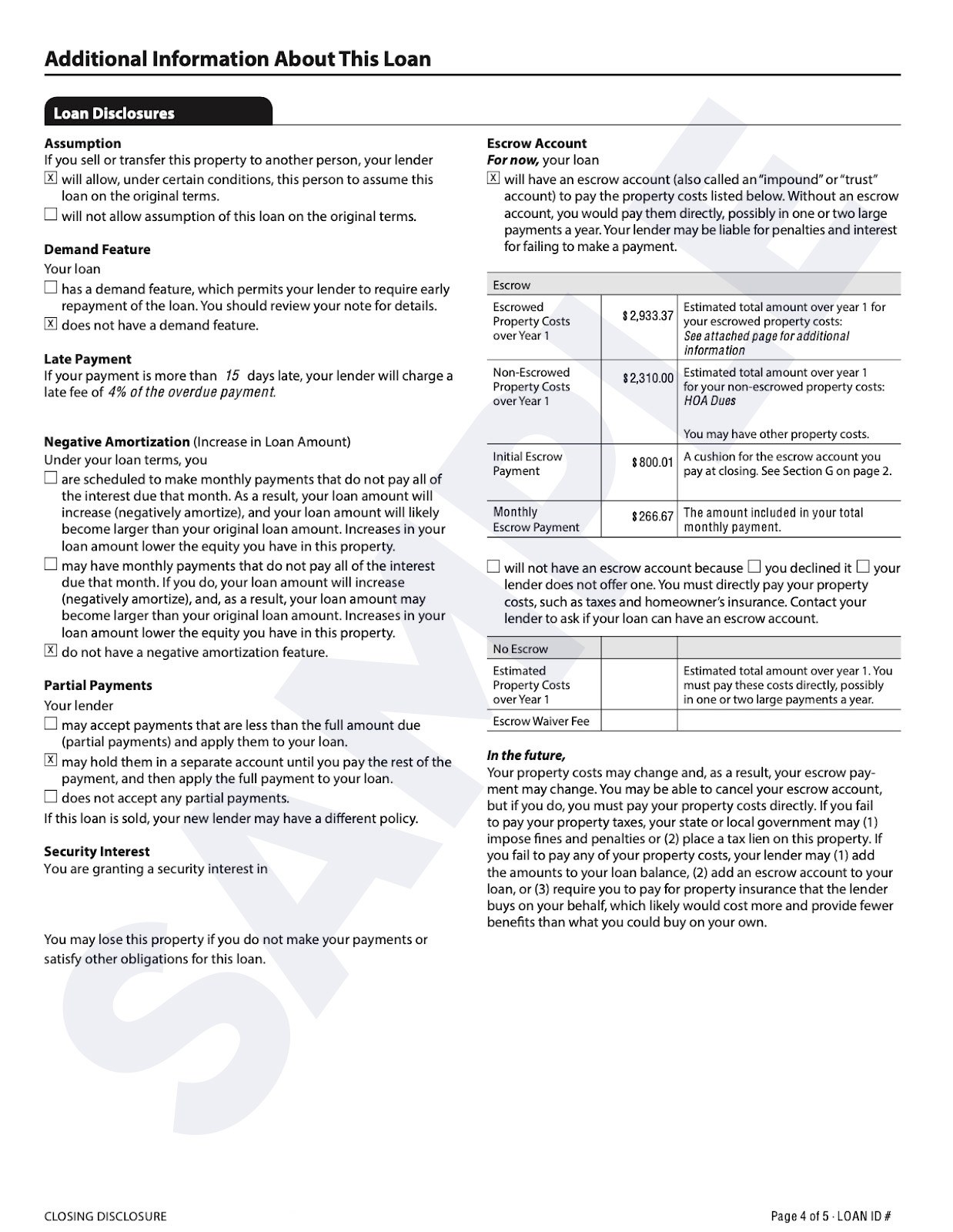

Page 4

The fourth page of the Closing Disclosure is where your personal loan disclosures live.

Your loan disclosures explain:

- Whether loan assumptions are permitted

- What kind of late payment deadline and fees come with the loan

- Whether your loan can accrue negative amortization, which happens when your monthly payments don’t cover all of the interest due; recent mortgage industry changes have made this risky feature increasingly rare

- Whether your lender will accept partial mortgage payments

- How much you’ll be escrowing for homeowners insurance and property taxes during the first year of the loan, and what that costs on a monthly basis

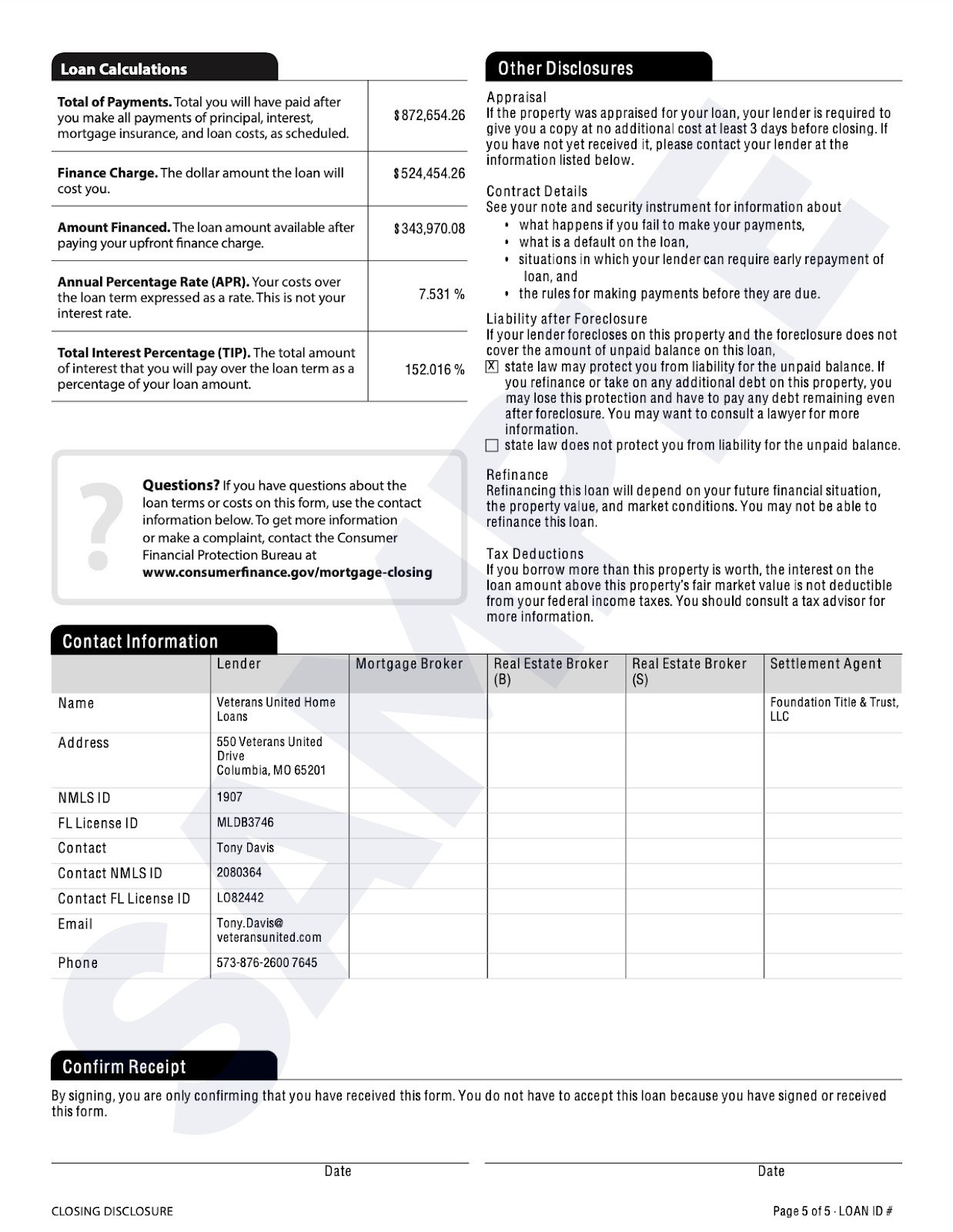

Page 5

The fifth (and final) page of the Closing Disclosure shows you how much the loan will cost over the entire term of the mortgage. You’ll also see your final Annual Percentage Rate (APR), which reflects the total costs of borrowing as a percentage rate and the Total Interest Percentage (TIP), which shows how much interest you’ll pay over the life of the loan as a percentage of your loan amount.

You’ll also find contact information for your lender, your real estate agent and other key stakeholders in your closing process.

What Happens First, Clear to Close or Closing Disclosure?

“Clear to close” (CTC) typically happens before you receive your Closing Disclosure. If you receive a clear to close, it means the underwriter has approved all documentation necessary for the title company to schedule the closing and start drafting the Closing Disclosure.

Does the Closing Disclosure Mean the Loan is Approved?

Signing the Closing Disclosure does not automatically mean your loan is approved. It is possible for your lender to find a last-minute red flag and back out of the contract. In other words, getting denied after the Closing Disclosure is issued is possible. This is why it is important to make sure there are no major changes to your credit or income during this period.

It’s also important to understand that big changes to your loan terms or last-minute changes to your contract could result in the need for an updated Closing Disclosure. Because the document must be disclosed to borrowers at least three business days before closing, the need for an updated disclosure will likely restart the 3-day timeline.

What Happens After the Closing Disclosure?

After signing the Closing Disclosure, the next step is typically the closing meeting, aka closing day. During the closing day, you and other parties involved, such as the seller, lender and title company representative, will gather to sign the final closing paperwork, and you will receive the keys to your new property.

Contact your lender or agent with any questions or concerns regarding the Closing Disclosure that you might have. No question is too small. Remember, the Closing Disclosure is meant to help buyers make informed decisions and ensure a clear and fair transaction.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Feb 12, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Content edited for grammar, readability and fact checked by underwriter Don Wilson.

Related Posts

-

What is Credit and Why It’s ImportantDiscover why credit matters when buying a house. Learn how a strong score unlocks lower rates, better loans, and more financial freedom.

What is Credit and Why It’s ImportantDiscover why credit matters when buying a house. Learn how a strong score unlocks lower rates, better loans, and more financial freedom. -

Home Inspection for VA Loans: Guidelines and ChecklistLearn about the purpose of a home inspection, common issues and how a home inspection differs from the VA appraisal.

Home Inspection for VA Loans: Guidelines and ChecklistLearn about the purpose of a home inspection, common issues and how a home inspection differs from the VA appraisal.