Choosing between a USDA and VA loan can be a challenging decision. Depending on your specific circumstances and qualifications, one loan type may be more favorable than the other.

USDA loans, offered by the United States Department of Agriculture, are ideal for low to moderate-income buyers looking to purchase in rural or suburban areas.

On the other hand, VA loans are backed by the Department of Veterans Affairs and available to Veterans, active duty service members and some surviving spouses.

When deciding between a VA loan or a USDA loan, it’s important to consider both the similarities and differences of each mortgage type.

USDA vs. VA Loan Volume

For 2024, over 36,000 USDA loans were originated compared to around 490,000 VA loans.

Based on the most recently updated HMDA data as of 2025.

VA Loan vs. USDA Loan Similarities

Although USDA and VA loans each cater to different demographics, they share similar benefits.

USDA loans and VA loans both:

- Are government-backed

- Require no down payment

- Don’t have a minimum credit score set

- Are for primary residences only

- Don’t require mortgage insurance

Differences Between USDA and VA Loans

Choosing between a USDA or VA loan can be a challenging decision. While some VA loan requirements are similar to USDA, the two have key differences.

Below is a table outlining the essential factors when comparing USDA loans to VA loans.

USDA vs. VA Loans: Key Differences

| Comparison Factor | USDA Loan | VA Loan |

|---|---|---|

| Eligibility | Available to the general public and property must be in an eligible rural area | Only available to active-duty service members, Veterans, members of the National Guard or Reserves and surviving spouses |

| Credit Score Minimum | None set, but typically around 640 | None set, but typically around 620 |

| Income Limit | 115% of the area’s median household income | None |

| Interest Rates | Typically higher than VA but may be lower for low-income applicants | Typically lower than USDA and not based on income |

| Loan Limit | Depends on the borrower’s income, location and size of household | None for Veterans with full entitlement |

| Property Requirements | Must serve as primary residence, be a single-family home and adhere to USDA MPRs | Must serve as primary residence, adhere to VA MPRs and buyer must move in within 60 days of closing |

| Program Fees | Upfront guarantee fee and annual fee | VA Funding Fee |

| Closing Costs | Typically 2 to 6% of the total loan amount and up to 6% seller concession | Typically 3 to 6% of the total loan amount and up to 4% seller concessions |

Eligibility

USDA loans and VA loans have very different eligibility requirements. USDA loans are designed for people with moderate to low incomes who want to buy homes in rural or suburban areas. To qualify, you must meet certain income levels, have a good credit score and the home must be in an eligible area.

VA loans are for Veterans, active duty service members, members of the National Guard or Reserves and surviving spouses. To qualify, you must meet specific military service requirements. Unlike USDA loans, your income or property location doesn’t affect your VA loan eligibility.

Takeaway: If you qualify for both a USDA and VA loan, compare your loan rates to see which is more affordable.

Minimum Credit Score

USDA and VA loans both offer credit score flexibility and do not have a set minimum, making homeownership more accessible. For a USDA loan, applicants typically should aim for a credit score of at least 640. This threshold allows lenders to streamline the application process.

VA lenders consider the entire financial profile of the applicant. This may include credit history, employment history and debt-to-income (DTI) ratio. Typically, VA lenders look for a credit score of 620 or higher.

Takeaway: While both loan types are accommodating, the VA loans offer more credit flexibility to prospective borrowers.

Income Limits

USDA loans and VA loans approach income limits very differently. For a USDA loan, specific income limits are set by the USDA. These limits depend on the property’s location and size of the household. For 2025, USDA income limits are $119,850 for 1 to 4 member households and $158,250 for 5 to 8 member households. Applicants must fall below the set income thresholds to qualify, ensuring these loans stay accessible to low to moderate-income homebuyers.

In contrast, VA loans don't have any income limits. Veterans and active-duty service members can earn any amount and still be eligible for a VA loan. VA loan eligibility focuses primarily on the borrower's military service history, not their income.

Takeaway: When considering income limits, VA loans are the preferred choice for buyers who exceed the USDA's income cap.

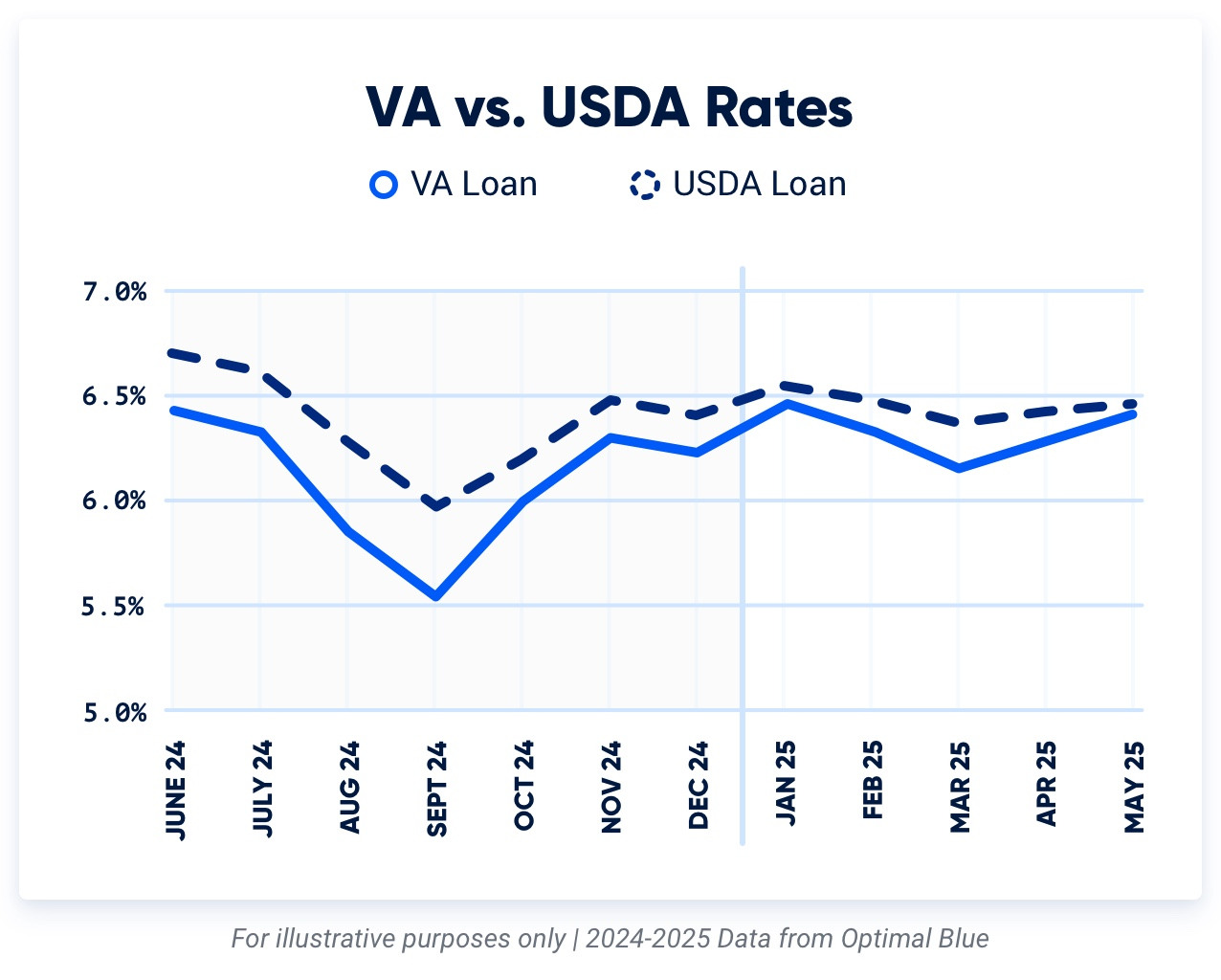

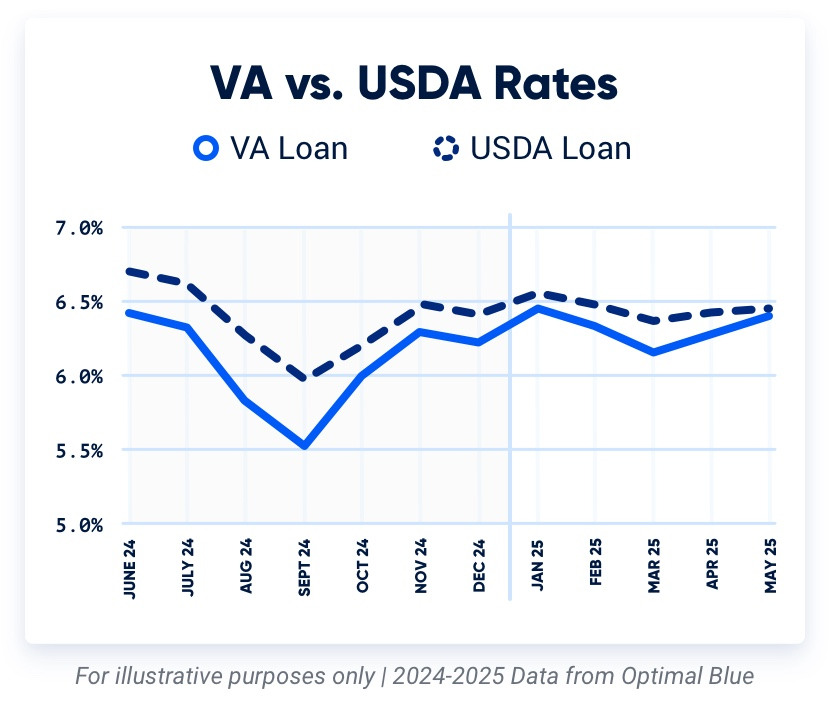

Interest Rates

Since VA and USDA loans are government-backed, they can offer more favorable interest rates. According to the mortgage data and analytics company Optimal Blue, VA loan rates remained .251% lower on average than USDA in 2024.

While USDA interest rates are lower than other loan types, a .251% difference when compared to VA interest rates can equal thousands in interest savings over the life of the mortgage.

Takeaway: Over the last year, VA interest rates were slightly lower than USDA. However, interest rates largely depend on your financial situation.

Loan Limits

USDA loans are subject to specific loan limits that depend on the borrower's income, location and size of the household. The limits vary depending on your situation, so it’s best to talk with your loan officer to determine your maximum loan amount. These limits are in place to ensure the program serves low to moderate-income homebuyers effectively.

Generally, VA loans don't have loan limits. In January 2022, a law was passed removing loan limits for first-time VA loan borrowers, allowing them to borrow as much as a lender is willing to lend without a down payment. However, limits may still apply to those who have previously used the VA loan benefit or reduced VA entitlement.

Takeaway: A VA loan typically offers more flexibility than a USDA loan if you have your full VA entitlement.

Property Requirements

A USDA loan is exclusively designed for homes located in eligible rural and suburban areas. The property must meet certain criteria and is obligated to an appraisal to ensure it’s safe, sanitary and structurally sound.

While VA loans are more flexible regarding the location, they still maintain strict standards for property conditions. VA-financed homes must pass a VA appraisal focusing on specific Minimum Property Requirements to ensure the home is safe, structurally sound and sanitary.

Takeaway: USDA and VA loans both require appraisals, but USDA loans are generally stricter due to location requirements.

Program Fees

USDA loans have an upfront guarantee fee and an annual fee. The upfront fee is 1% of the loan amount due at closing, while the annual fee of 0.35% is paid monthly. Although these fees aren't as high as traditional private mortgage insurance (PMI), the annual fee is ongoing for the life of the loan.

VA loans have a one-time funding fee. The amount varies from 1.25% to 3.3% of the loan amount, depending on the down payment amount and whether this is the borrower’s first VA loan. For first-time use of a VA purchase loan, the funding fee is 2.15% of the loan amount. It can be paid upfront or rolled into the total loan amount. Some VA loan applicants are exempt from paying the funding fee and may waive the fee altogether.

For a USDA loan of $200,000, the total amount financed would be $202,000 with an additional $700 annual fee. For a VA loan of $200,000, the total amount financed would be $204,600 with no annual fee. It would take approximately 4 years for the total cost of the USDA loan to exceed the VA loan when factoring in the annual fee. After this point, the USDA loan will effectively be more expensive than the VA loan.

Takeaway: VA loans may be more cost-effective, but each situation is unique. Always calculate the total costs over the life of the loan.

Closing Costs

USDA loans typically have closing costs ranging from 2% to 6% of the total loan amount. These can often be rolled into the loan or covered by up to 6% seller concessions, easing the initial financial outlay for the buyer.

In contrast, closing costs for VA loans typically range from 3% to 6% of the total loan amount, but the VA caps how much a Veteran can pay through “non-allowable fees.” Seller concessions are allowed up to 4%.

Takeaway: If you're on a tight budget, USDA seller concessions are more favorable at up to 6% of the loan amount.

Which is Better a USDA Loan or a VA Loan?

Deciding if a USDA or VA home loan is better depends on your situation and needs.

A VA loan might be the best option if you want to avoid income and loan limits or your credit score is on the lower end. Although there is a one-time VA Funding Fee, you may qualify for an exemption, which isn’t possible for USDA program fees.

A USDA loan may be a better option if you are looking to purchase a home in an eligible rural area or meet the low to moderate income limit. These loans also allow more opportunity when negotiating costs with the home seller.

No matter what your homebuying goals are, Veterans United is here to help. Talk with a VA home loan expert to get a complete comparison for your unique homebuying journey.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Jun 20, 2025

Written ByMitch Casteel

Updated data figures to reflect 2025 data.

Apr 3, 2025

Written ByMitch Casteel

Added USDA and VA loan origination comparisons for 2024 based on updated Home Mortgage Disclosure Act (HMDA) data.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan.

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan. -

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.