During a time of unprecedented health and economic challenges, the historic VA home loan program is having its biggest year ever.

VA loan utilization is up 114 percent through the first three quarters of Fiscal Year 2020 compared to the same period last year, according to Department of Veterans Affairs data. A surge in refinance loans is driving the increase, as Veteran homeowners across the country continue to capitalize on interest rates at or near modern-day lows.

Through the first three quarters of FY20, VA refinance loans have increased a whopping 315 percent year over year. Purchase loans were up 11.5 percent year over year.

In all, the VA loan program backed more than 865,000 loans in Q1-Q3. That's already an all-time record, and the VA's fiscal year doesn't end until Sept. 30. This 76-year-old benefit program will likely guaranty more than 1 million loans this fiscal year.

The previous record of 740,386 loans was set in 2017, which can be seen here.

COVID-19 Impacts on VA Lending

The VA's third quarter started in April, a few weeks after the coronavirus was declared a national emergency and just days after the CARES Act was signed into law. VA lending was already up year-over-year heading into the third quarter because of the low-rate environment.

While the coronavirus has slowed the process of securing a VA loan in some places, the pandemic did little to tamp down demand in the weeks and months that followed.

Looking just at the Q3 data (April through June 2020), a few trends and storylines stand out:

- VA refinance loans increased 296 percent year over year, and every age demographic saw a quarter-over-quarter increase

- VA purchase loans were up 7 percent year over year, with Millennial and Generation Z Veterans fueling the growth; in fact, they were the only age demographics to experience a year-over-year increase in FY20 Q3

- Millennial homeowners had the biggest year-over-year jump in VA refinance (463 percent)

- Refinance loans were up in Seattle 275.74 percent during the first three VA fiscal quarters of 2020 compared to the same time period in 2019 and millennial purchase loans were up 21.79 percent.

For Veterans with income and employment stability, the third quarter was a historic time to purchase or refinance from an interest rate perspective.

To be sure, the coronavirus also introduced challenges for prospective borrowers. Many lenders tightened their credit requirements and introduced additional employment checks. Shelter-in-place orders brought changes to home tours, appraisals and home inspections in some parts of the country.

Still, the average VA purchase loan closed in 47 days in June, a day faster than the year before, according to Ellie Mae data.

Top Metro Areas for VA Loan Growth

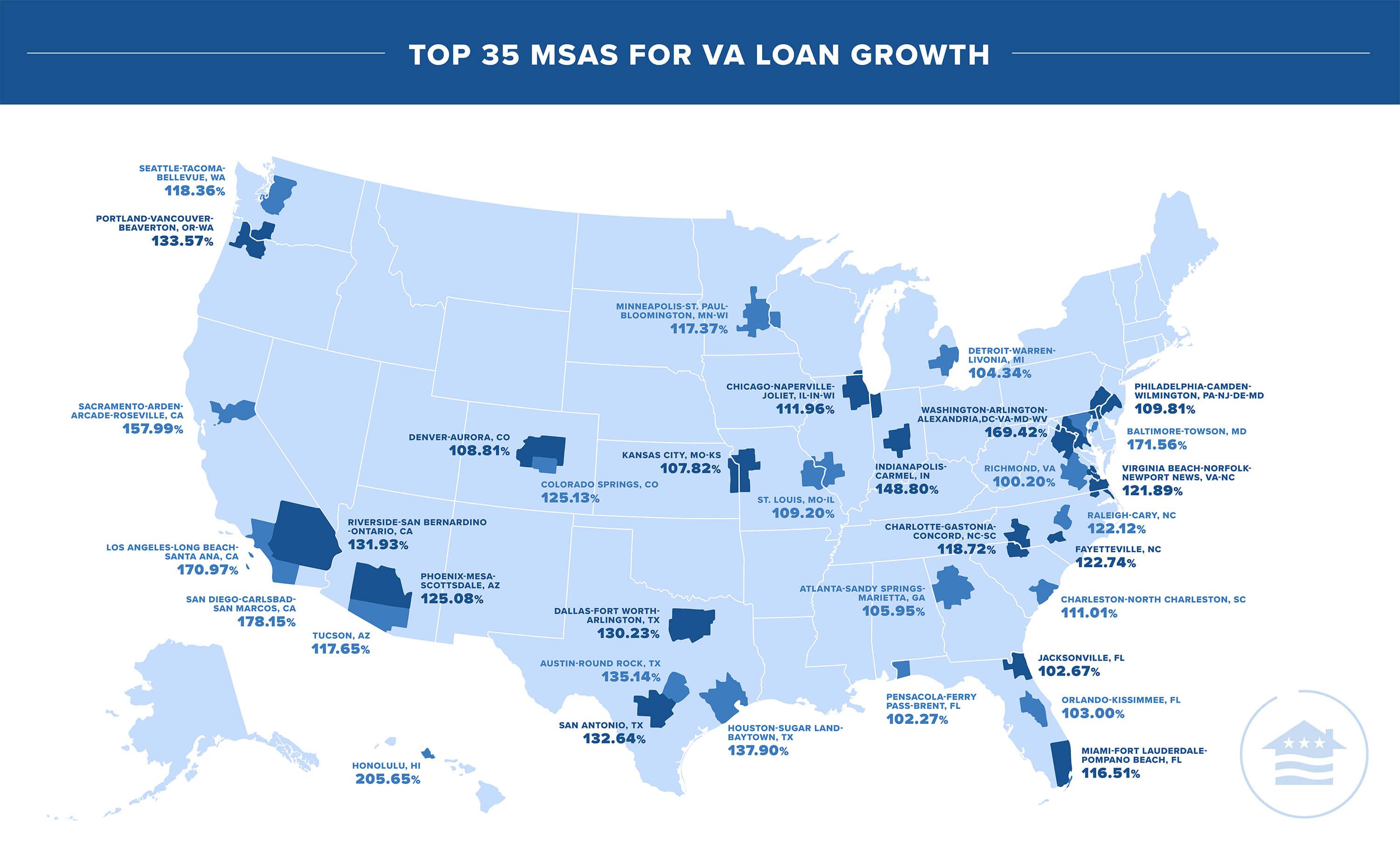

The VA lending boom in the wake of the coronavirus was felt in Metropolitan Statistical Areas (MSAs) across the country. In all, 35 MSAs saw total VA loans increase 100 percent or more in FY20 Q3 compared to the third quarter of FY19. Six markets experienced year-over-year growth in excess of 150 percent.

Here's a look at the 35 MSAs that saw the biggest year-over-year growth in VA loans in Q3 (click to enlarge):

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.