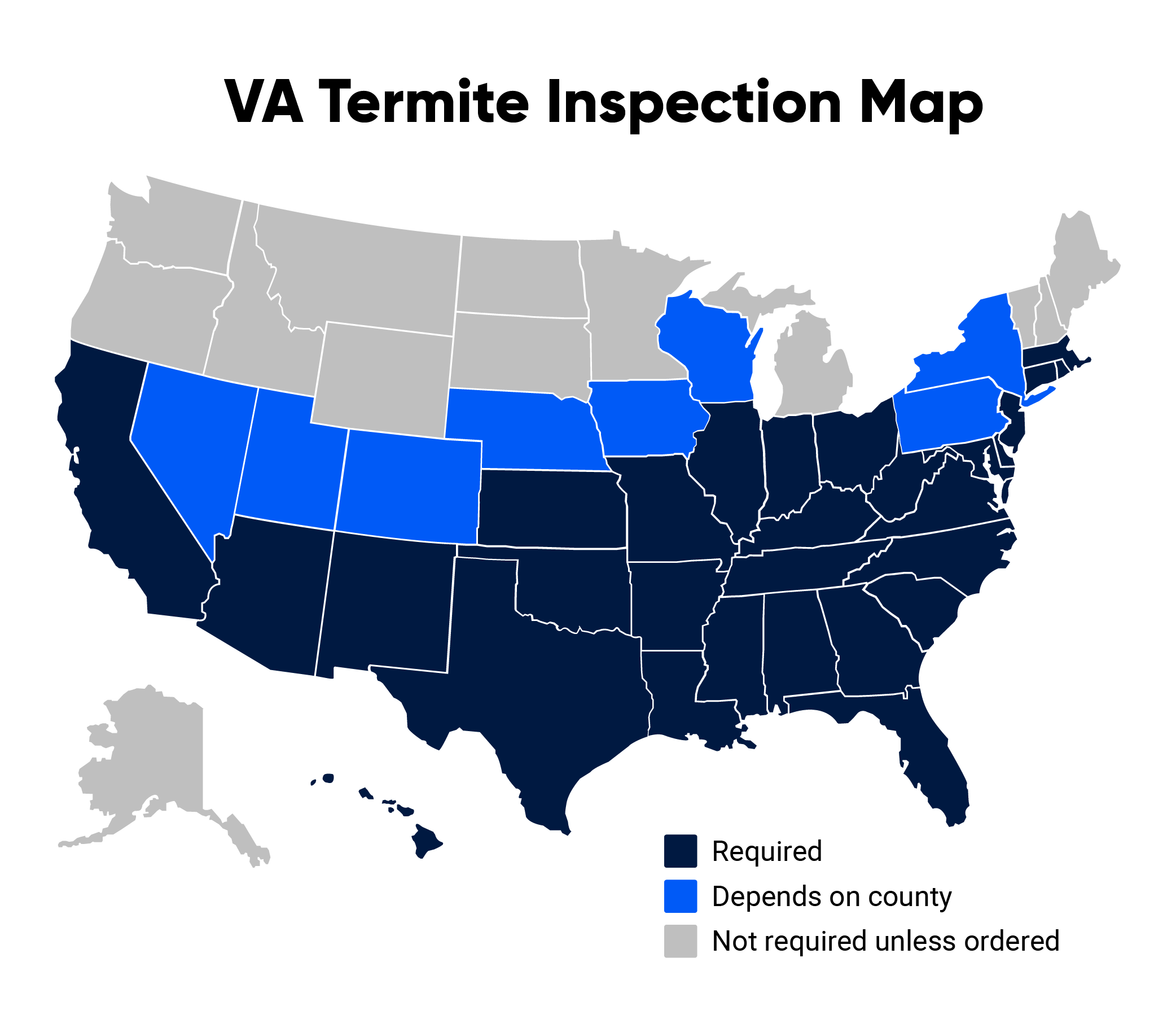

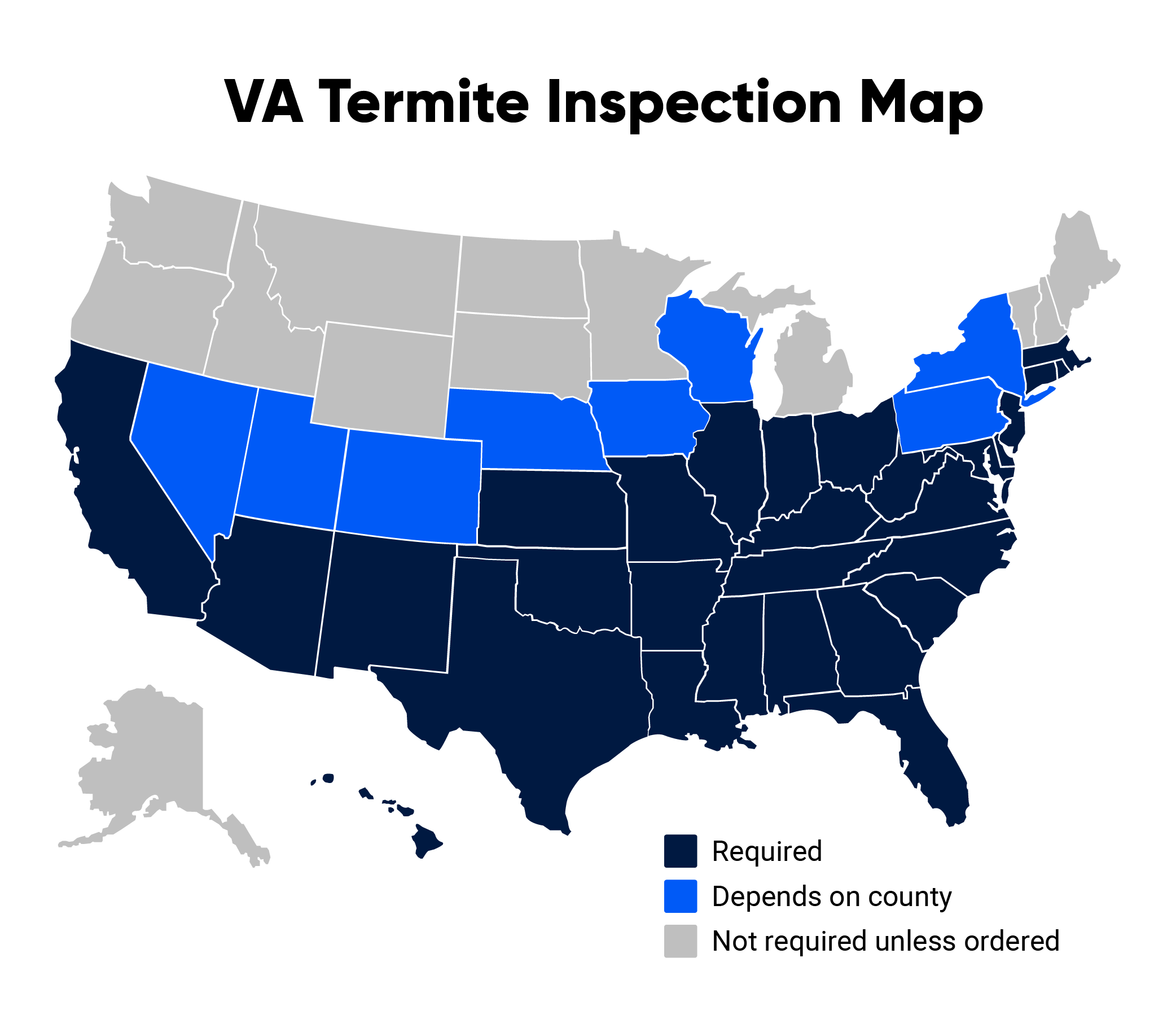

- The VA requires a wood-destroying pest inspection for most of the United States.

- Certain states and counties only require a termite inspection if the VA appraiser discovers an issue.

The VA home loan program helps Veterans, service members and military families buy homes that are move-in ready. Properties that are safe, sound and sanitary. Not exactly the flashiest words, but you can also think of it as “termite-free.”

The VA requires a wood-destroying pest inspection in certain parts of the country and in low-rise and high-rise condo units when the VA appraiser observes a potential pest problem.

Termites might be small, but the damage they cause is anything but. According to Orkin, more than 600,000 homes are hit every year, costing U.S. homeowners around $5 billion. That’s a lot of stress and money the VA wants to help you avoid.

When is a VA Termite Inspection Required?

Termites are more prevalent in some places than others. More than 30 states require a pest inspection before a VA home loan closes. They're discretionary in others, although there's a handful of states where individual counties mandate an inspection.

VA loans now require a termite pest inspection for homes located in areas where the probability of infestation is considered "Moderate to Heavy" or "Very Heavy."

The VA isn’t trying to make the process harder. It’s helping you make a smart, safe investment.

VA Loan Termite Inspection Requirements by State

One of the first questions for VA borrowers is, "Will I have to get a termite inspection?" Unless you're pursuing a VA Streamline refinance, the answer is yes if the property is in one of these states:

- Alabama

- Arizona

- Arkansas

- California

- Colorado (only required for these counties: Alamosa, Arapahoe, Archuleta, Baca, Bent, Chaffee, Cheyenne, Conejos, Costilla, Crowley, Custer, Delta, Dolores, Douglas, El Paso, Elbert, Fremont, Gunnison, Hinsdale, Huerfano, Kiowa, Kit Carson, La Plata, Lake, Las Animas, Lincoln, Mineral, Montezuma, Montrose, Otero, Ouray, Park, Phillips, Prowers, Pueblo, Rio Grande, Saguache, San Juan, San Miguel, Summit, Teller, Washington and Yuma.)

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Illinois

- Indiana

- Iowa (only required for these counties: Adair, Adams, Allamakee, Appanoose, Audubon, Benton, Black Hawk, Boone, Bremer, Buchanan, Butler, Calhoun, Carroll, Cass, Cedar, Chickasaw, Clarke, Clayton, Clinton, Crawford, Dallas, Davis, Decatur, Delaware, Des Moines, Dubuque, Fayette, Floyd, Franklin, Fremont, Greene, Grundy, Guthrie, Hamilton, Hardin, Harrison, Henry, Humboldt, Ida, Iowa, Jackson, Jasper, Jefferson, Johnson, Jones, Keokuk, Lee, Linn, Louisa, Lucas, Madison, Mahaska, Marion, Marshall, Mills, Monona, Monroe, Montgomery, Muscatine, Page, Polk, Pottawattamie, Poweshiek, Ringgold, Sac, Scott, Shelby, Story, Tama, Taylor, Union, Van Buren, Wapello, Warren, Washington, Wayne, Webster, Winneshiek and Wright.)

- Kansas

- Kentucky

- Louisiana

- Maryland

- Massachusetts

- Mississippi

- Missouri

- Nebraska (only required for these counties: Adams, Boone, Buffalo, Burt, Butler, Cass, Chase, Clay, Colfax, Cuming, Custer, Dawson, Dodge, Douglas, Dundy, Fillmore, Franklin, Frontier, Furnas, Gage, Gosper, Greeley, Hall, Hamilton, Harlan, Hayes, Hitchcock, Howard, Jefferson, Johnson, Kearney, Lancaster, Madison, Merrick, Nance, Nemaha, Nuckolls, Otoe, Pawnee, Perkins, Phelps, Platte, Polk, Red Willow, Richardson, Saline, Sarpy, Saunders, Seward, Sherman, Stanton, Thayer, Thurston, Valley, Washington, Webster and York.)

- Nevada (only required for these counties: Carson City, Churchill, Clark, Douglas, Esmeralda, Lincoln, Lyon, Mineral, Nye, Pershing, Storey, Washoe and White Pine.)

- New Jersey

- New Mexico

- New York (only required for these counties: Bronx, Broome, Columbia, Delaware, Dutchess, Greene, Kings, Nassau, New York, Orange, Putnam, Queens, Richmond, Rockland, Suffolk, Sullivan, Ulster and Westchester.)

- North Carolina

- Ohio

- Oklahoma

- Pennsylvania (only required for these counties: Adams, Allegheny, Armstrong, Beaver, Bedford, Berks, Blair, Bucks, Butler, Cambria, Cameron, Carbon, Centre, Chester, Clarion, Clearfield, Clinton, Columbia, Crawford, Cumberland, Dauphin, Delaware, Elk, Erie, Fayette, Forest, Franklin, Fulton, Greene, Huntingdon, Indiana, Jefferson, Juniata, Lackawanna, Lancaster, Lawrence, Lebanon, Lehigh, Luzerne, Lycoming, McKean, Mercer, Mifflin, Monroe, Montgomery, Montour, Northampton, Northumberland, Perry, Philadelphia, Pike, Potter, Schuylkill, Snyder, Somerset, Sullivan, Tioga, Union, Venango, Warren, Washington, Westmoreland, Wyoming and York.)

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah (only required for these counties: Beaver, Garfield, Iron, Kane, San Juan and Washington.)

- Virginia

- West Virginia

- Washington, D.C.

- Wisconsin (only required for these counties: Columbia, Crawford, Dane, Dodge, Grant, Green, Iowa, Jefferson, Kenosha, Lafayette, Milwaukee, Ozaukee, Racine, Richland, Rock, Sauk, Vernon, Walworth, Washington and Waukesha.)

The U.S. territories that require a termite inspection are U.S. Virgin Islands, Guam, American Samoa, Puerto Rico and Commonwealth of the Northern Mariana Islands.

In other states, you'll need to get a pest inspection only if the independent VA appraiser notes an issue during the appraisal process. Pest inspections are merely discretionary in these states:

- Alaska

- Idaho

- Maine

- Michigan

- Minnesota

- Montana

- New Hampshire

- North Dakota

- Oregon

- South Dakota

- Vermont

- Washington

- Wyoming

Professional pest inspectors will scour potential entry points around the house, both inside and out, looking for telltale signs of termite infestation.

Damaged wood is obviously a dead giveaway, but there are other indicators that might signal a problem. Any issues will need to be cleared up before you can move forward with your VA loan.

Many homebuyers find learning about the VA's Minimum Property Requirements helpful when preparing for a pest inspection.

VA Loan Termite Inspection Costs

Historically, most VA loan borrowers weren't allowed to pay for termite inspections as part of their home purchase due to VA non-allowable fees. However, in June 2022, the VA updated its regulations to allow all borrowers to cover termite inspection reports when the inspection is required.

In addition to the inspection itself, VA borrowers are also allowed to pay for repairs if they’re needed to meet the VA’s Minimum Property Requirements.

The cost of a termite pest inspection varies depending on home size, location and infestation severity. On average, homebuyers should expect to pay around $100 to $200, though sellers are often willing to cover this fee after negotiation.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Jul 16, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Updated content based on VA regulation changes.

Jul 14, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Updated content based on VA guidelines change.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

- Orkin. More than 600,000 homes are hit every year, costing U.S. homeowners around $5 billion.

- Department of Veterans Affairs. VA updated its regulations to allow all borrowers to cover the cost of termite inspection reports; Required when probability of infestation is considered "Moderate to Heavy" or "Very Heavy."

- Angi. On average, homebuyers should expect to pay around $100 to $200.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.